Understanding Transaction Analysis: Key Concepts and Techniques by Aysha Saifi HustleVentureSG

However, the figures to be reported are not impacted by the specific mechanical steps that are taken. Referencing an illustration of the accounting equation above, let’s perform the accounting transaction analysis of a business transaction. Brian Kimberly invested $55,000 cash and office equipment valued at $8,850 in the company in exchange for its common stock. As you can see, debits and credits do the opposite of each other. Therefore, when you use the double-entry method, for every debit you have, there will be a corresponding credit equal to the same amount, and vice versa. This keeps your accounting equation in balance, so you know that if it’s not balanced, then you’ve made a mistake in your bookkeeping.

Common Scenarios Where a Paper LBO is Used

We could actually go ahead and complete interest expense, but we’ll come back to that later. Even if we leave interest expense blank at this point, we can still calculate everything else including taxes and net income. When creating a Sources and Uses schedule, always begin with the uses. In this case the only use will be the purchase enterprise value. In a full LBO, there will be other uses, including transaction-related fees. As shown below, the last twelve months (LTM) revenue is $100 million, the revenue growth rate is 10%, and the EBITDA margin is 60%.

Financial Model Down to Free Cash Flow

For example, with a $300 million equity investment, this represents 5x EBITDA ($300 million/$60 million). EBITDA margins (EBITDA as a percentage of revenue) and the income tax rate. A paper LBO (leveraged buyout) is a simplified version of a full LBO model that is used to quickly estimate the potential returns of a leveraged buyout transaction. While a full LBO model involves detailed financial modeling, a paper LBO focuses on key assumptions and simplified calculations. A paper LBO is done without Excel or a financial calculator, with only a pen and paper, hence the name. 4) This comment shows a high degree of emotional intelligence and is looking for answers and solutions.

What account type does each of the accounts involved belong to?

- In the second step, classify the nature of the accounts identified in the first step.

- The account titles so obtained must be in line with the account titles listed in the organization’s chart of accounts (COA) and used in the general ledger.

- Please note that the above numbers will change when we complete the debt schedule and calculate interest expense.

- The accounting cycle is a step-by-step process to record business activities and events to keep financial records up to date.

- Read them all from our article classification of accounts.

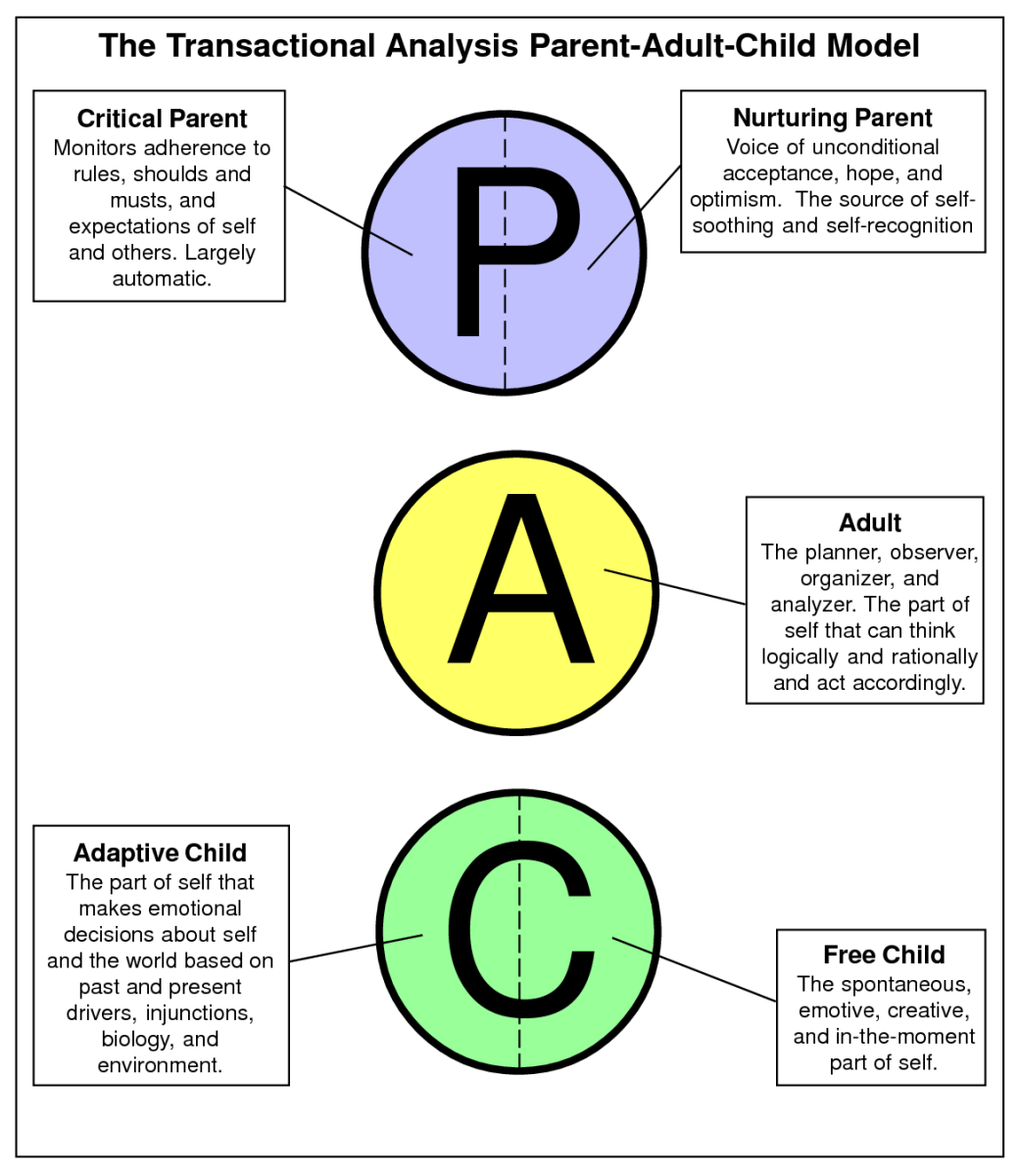

- Whereas the child and parent state may be driven by past experiences and conditioning, the adult state considers the here and now situation.

In the above example, cash is an asset account and capital is an owner’s equity/capital account. Consider learning more about the classification las vegas tax return preparer sentenced to more of accounts. Since the debt balance won’t change over the forecast period, this simplifies the calculation of interest expense.

This is a transaction because it can be measured in terms of money and will change the financial position of the business. Cash will increase by $1,00,000 and capital will increase by Rs.1,00,000. Accountants view financial transactions as economic events that change components within the accounting equation. These changes are usually triggered by information contained in source documents (such as sales invoices and bills from creditors) that can be verified for accuracy.

Explore Business Topics

As you can see, the cycle begins with identifying and analyzing transactions. The entire cycle is meant to keep financial data organized and easily accessible to both internal and external users of information. This article is not intended to provide tax, legal, or investment advice, and BooksTime does not provide any services in these areas. This material has been prepared for informational purposes only, and should not be relied upon for tax, legal, or investment purposes.

After ascertaining the nature of the accounts, it is necessary to determine which account is increasing and which one is decreasing as a result of the transaction. This is necessary for the proper application of rules of debit and credit on each account. It is a transaction because it will change the financial position of the business. Cash will decrease by $12,000 and salaries (expense) will increase by $12,000. Double-entry bookkeeping is the accounting method you use to track where your company’s money comes from and where its money goes.

Their rules are their rules, and everyone should abide by them. If they don’t, then they are judges as wrong, or inconsistent, or selfish, or similar. Feedback could be delivered in an aggressive, passive-aggressive or harsh way.

This can be the essence of an ulterior transaction, where an underlying, subtle message from one state could be interpreted as another state by the other person. Similarly, if both are in a parent state, you may find both of them wanting their own way and still not able to find solutions to their issues. Hence, an adult-adult complementary state is the best one to find results. A critical parent state may well judge others by what they ‘should’ or shouldn’t’ do.

The other account involved is John’s capital account, which would be credited. Finally, we can calculate the exit equity value and approximate the multiple of invested capital (MOIC) and the IRR. Remember, it’s important to simplify this exercise and only calculate numbers you absolutely have to. Now, we can move on and complete most of the income statement.