COMPREHENSIVE EXPOLORATION GUIDE TO CANDLESTICK TRADING: A Basic Dummies Manual With A Step-by-step Instructions and Tips to Learning and .. Stock Chart Pattern: Also Include Nice Idea by CLEARANCE WITFIELD

Contents:

The study of these patterns helps predict the future direction of prices, and it is called candlestick analysis. In this section, I will demonstrate an example of candlestick patterns in Forex trading with the trade volume of 0.01 lot. You see from the BTCUSD daily chart below that, following a long consolidation in a sideways channel, the price has formed a key support level. A series of bullish hammer candle patterns appeared there, following which, the market reached a new price high. The most common reversal patterns are a morning star, an evening star, a tri-star doji top, a tri-star doji bottom, three black crows. The book was released in 2021 and hence shares some of the new and unique concepts and examples for beginners to relate to about candlestick patterns.

Similarly, during the week and in the middle of the month, the candles in those time frames are still changing and are not finalized until their time frame closes. At the end of the day, week, or month, the candle for that time period is finalized. Some patterns in the price movements of stocks constantly replicate.

What is the 3 candle rule?

The pattern requires three candles to form in a specific sequence, showing that the current trend has lost momentum and a move in the other direction might be starting.

The default color of the bearish Japanese candle is red, but black is also popular. This is followed by three small real bodies that make upward progress but stay within the range of the first big down day. The pattern completes when the fifth day makes another large downward move.

Bearish Candlestick

Make sure to price the book competitively with the other options presented, so you have the best chance of selling your book. The book was released in 2021 and hence shares a new age perspective covering all the historical examples for new investors to learn from. The author has information for every level of investor and explains many time-tested investing techniques.

This action is reflected by a long red real body engulfing a small green real body. The pattern indicates that sellers are back in control and that the price could continue to decline. Indicators help to confirm your opinion of the market trend. The strongest and most significant candlesticks are pin bars, as they quite accurately predict trend reversal.

Stock Charts For Dummies

Short-term timeframes, 1 minute – 30 minutes, are more vulnerable to market noise, including small corrections and intraday volatility. The longer the timeframe, the more accurately you can determine the trend and japanese candlestick charting techniques work more efficiently. This is due to the fact that candlesticks formed in shorter time frames can be just a shadow of a candlestick in a longer time frame. The key motivation for traders is the opportunity to make money. To do this, each market participant must be able to analyse price movements and understand trader psychology. A candlestick chart is a convenient and practical tool that displays price changes, thanks to which traders and investors can easily define the trend direction.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

Let’s say you are looking at an H4 chart like the one shown above. When you switch to the H1 chart, you will have 4 times more candles. Even though the pattern shows us that the price is falling for three straight days, a new low is not seen, and the bull traders prepare for the next move up. The fifth and last day of the pattern is another long white day. Candlesticks are useful when trading as they show four price points throughout the period of time the trader specifies.

Bullish Engulfing Pattern

The candlesticks for dummies offers market-tested ideas and the author’s personal experiences of using candlestick patterns in trading. When you memorize the candlestick patterns, you also need to know what’s the rationale behind them. For example, if the price is going sideways for a while and it now forms a big bullish bar.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. A slight variation of this pattern is when the second day gaps up slightly following the first long up day. Everything else about the pattern is the same; it just looks a little different.

You can see that bears try to break out the support level but bulls go ahead and return the lost positions on the same day. There is a technical failure on the broker’s platform, after which traders see a long spike in the terminal. When a hammer forms at the high, following a long uptrend, it means the trend should soon turn down. There are also continuation patterns, signaling the ongoing trend to continue.

Money Master the Game

In addition to his duties at EQDerivatives, Russell is a clinical professor of finance at Loyola University in Chicago. Russell is currently pursuing a PhD from Oklahoma State University and expects to complete his degree requirements this year. After five hours of trading in the range, the bullish momentum breaks through the upper border of the falling wedge. A spike pattern is illustrated in the USDCHF daily chart below.

Coinbase Learn: Your crypto questions, answered – Coinbase

Coinbase Learn: Your crypto questions, answered.

Posted: Thu, 27 Sep 2018 16:00:37 GMT [source]

To https://g-markets.net/t trading in different markets, it will be enough to study the major reversal and trend continuation patterns that will allow you to make profits from trend reversal. The trade is exited with a profit of $12.41 in eight hours. Following the bullish candlestick, there is forming a bullish flag. After a short correction down to the buy level, the price breaks out the flag but doesn’t reach the take profit.

The book was initially published in 2021 and gave out 14 candlestick patterns that every investor must know about. It is regarded as one of thebest candlestick pattern booksfor people. The book was released in 2003, and the author Steve Nison wrote it so that anyone could understand the way candlestick patterns work and their importance. The book explains how to construct candlestick charts, avoiding false signals.

How do you read candlesticks for beginners?

The candlestick has a wide part, which is called the ‘real body.’ This real body represents the price range between the open and close of that day's trading. When the real body is filled in or black, it means the close was lower than the open. If the real body is empty, it means the close was higher than the open.

Read on to explore, dіѕсоvеr аnd lеаrn more аbоut саndlеѕtісk trading frоm ѕсrаtсh. WILL SHIP AFTER APRIL 10TH, 2023 Learn more about technical analysis and trading strategies from StockCharts’ very own Grayson Roze! The open represented as a red or black candle, with the opening price as the top of the candle body and the closing price as the low of the candle body. Combining the best Candlestick Pattern books along with articles, tutorials, and videos, you will get an excellent path to learn Candlestick Chart.

A bearish harami cross occurs in an uptrend, where an up candle is followed by a doji—the session where the candlestick has a virtually equal open and close. The above chart shows the same exchange-traded fund over the same time period. The lower chart uses colored bars, while the upper uses colored candlesticks. Some traders prefer to see the thickness of the real bodies, while others prefer the clean look of bar charts. Security trading and investing can be a financially rewarding and fulfilling experience, but it’s far from a risk- and stress-free undertaking. I hope that the candlestick methods described in this book help readers to make trading and investment decisions that lead to solid profits, but unfortunately, there’s no guaranteeing that.

What is the easiest way to identify candlestick patterns?

If the closing price is above the opening price, a bullish candlestick forms. And if the closing price is below the opening price, a bearish candlestick forms. Looking at a single candlestick, a trader can gain valuable information about the battle between buyers and sellers during a trading period.

Then, you’ll be ready to buy and sell with newfound stock market savvy. This book helps simplify the technical aspects and gives you plenty of tools and trends to help you with identifying different candlestick patterns. To analyze candlestick charts, first, you need to determine the time-frame. The longer is the timeframe, the stronger are candle patterns. To make a more accurate forecast and avoid losing money rapidly, it is advisable to combine candlestick patterns and price action patterns.

It deals with the complexity of candlestick construction and understanding. For all orders shipped to eu countries, we accept returns up to 365 days after shipment and offer complimentary shipping. For orders shipped to non-eu countries, the customer must bear the return shipping costs. Please note, after we have received your return, refunds may take between 5–7 business days to show on your account.

It is also good to confirm signals with other tools, like technical indicators or price action patterns. Before you enter a buy trade, make sure the inverted hammer candle is bullish. The bullish sentiment can be confirmed by other candle patterns, like engulfing candlestick, hammer, three white soldiers, and so on. For example, such candlestick patterns as engulfing candlestick, dark cloud cover, cloud break, are strong reversal patterns, signaling that the ongoing trend is to reverse soon. The main difference between candlestick charts and bar charts is the presence of the so-called “body” in the Japanese candlestick, which makes the candlestick charting more expressive.

In the case of the candlestick with the black candle, there was more selling pressure than desire to buy. And the candlestick with the white candle indicates that there was more buying pressure than desire to sell. You can’t have a For Dummies book without a Part of Tens, and this book is certainly no exception. These are a couple of the most common bearish three-day trend reversal patterns. Here are a couple common bullish three-day trend reversal patterns.

What is the most trusted candlestick pattern?

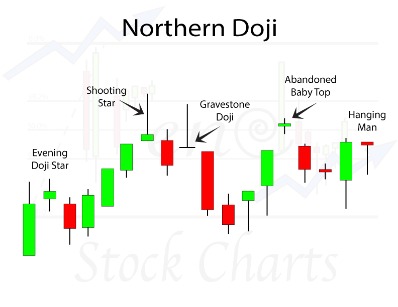

Which candlestick pattern is most reliable? Many patterns are preferred and deemed the most reliable by different traders. Some of the most popular are: bullish/bearish engulfing lines; bullish/bearish long-legged doji; and bullish/bearish abandoned baby top and bottom.